The tempered pace of new launches during Q2-2025 reflects a maturing market— one where supply is increasingly aligned with end-user demand

By ANUJ PURI

Chairman -ANAROCK Group

Q2 2025 represented a positive yet transitional phase for India’s housing sector, demonstrating resilience amid rising property prices and global uncertainties.

While residential sales volume across the top 7 cities declined by 20% year-on year to approximately 96,300 units, the total sales value grew by 1% to INR 1.47 lakh Cr, reflecting a shift toward higher-value purchases.

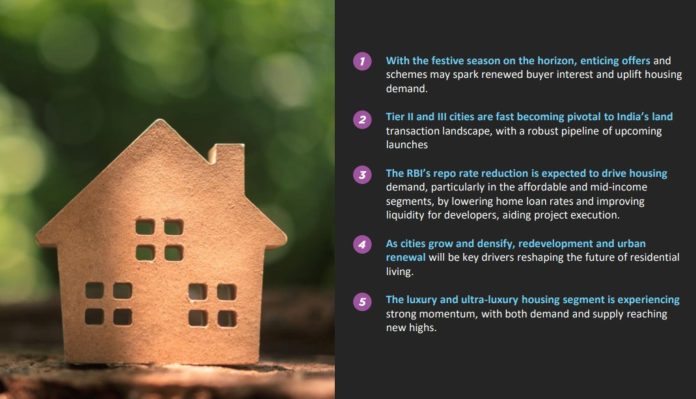

Supported by the Reserve Bank of India’s three consecutive repo rate cuts, which eased home loan rates and boosted buyer confidence, quarterly sales rose 3% compared to Q1 2025. Notably, sales in both quarters of 2025 exceeded pre-COVID levels (2015–2019) by 44%, with average quarterly sales previously at only 66,700 units, underscoring sustained long-term growth despite short-term market adjustments.

Average property prices surged by 11% annually across the top 7 cities. The steepest hikes were seen in the National Capital Region (NCR) at 27%, followed by Bengaluru at 12%, pushing affordability beyond the reach of many buyers and ultimately dampening demand across segments.

Despite the cooling trend, the Mumbai Metropolitan Region (MMR) and Pune retained their leadership positions, accounting for 49% of the total residential sales. However, both markets felt the impact of the broader correction— MMR saw a 25% annual drop in sales, while Pune experienced a sharper decline of 27%. Chennai, in contrast, stood out for its relative stability, posting a 13% growth among the top 7 cities.

On the supply front, new launches fell below the one lakh unit threshold and declined 16% year-over-year to approximately 98,600 units, down from 1,17,100 units in Q2 2024. When compared to the pre-COVID period, the average launches accounted for 60,300 units in every second quarter of the calendar year, which has been surpassed by 64% in Q2 2025.

MMR and NCR led in new supply, contributing a combined 48% of total launches. While MMR witnessed a steep 36% annual drop in new inventory, Chennai saw a notable 63% increase. NCR and Kolkata also bucked the broader trend, registering moderate growth in launches at 11% and 16%, respectively.

Over the past few years, demand has remained strong in the luxury and premium housing segments, with growing interest in the ultra-luxury category.

This surge has attracted an increasing number of national and international brands entering the market to capitalize on rising demand. In Q2 2025, the supply share of luxury (INR 1.5 Cr – INR 2.5 Cr) and ultra-luxury (above INR 2.5 Cr) housing grew by 15% and 3% year-on-year, respectively, across the top 7 cities.

A detailed look at the supply composition shows that luxury homes priced between INR 1.5 Cr and INR 2.5 Cr led the market, accounting for 27% of total supply in Q2 2025. This was followed by the high-end segment (INR 80 lakh – INR 1.5 Cr) and mid-end segment (INR 40 lakh – INR 80 lakh), each contributing 21%. The ultra-luxury segment made up 19% of overall supply.

In contrast, the affordable housing category (below INR 40 lakh) remained stagnant, contributing only 12% of new launches. This trend reflects a shift among developers toward higher-margin inventory, driven by sustained demand for premium and luxury offerings.

Despite subdued sales, the overall available stock across the top 7 cities declined 3% year-on-year to approximately 5,62,150 units by the end of Q2 2025. Pune recorded the most significant drop in available inventory at 15% year-on year, reflecting stronger demand relative to supply. Meanwhile, Bengaluru’s available inventory jumped by 30% annually.

To conclude, India’s residential real estate sector appears to be undergoing a strategic pause—a shift from rapid expansion to more grounded growth.

Even as property prices continue their upward trajectory and macroeconomic headwinds persist, the current slowdown seems less a sign of distress and more a necessary adjustment toward long-term stability.

However, sales and launches have already surpassed the pre-COVID period by 44% and 64%, respectively. After a period marked by aggressive launches and record sales, developers are now exhibiting a more cautious and quality-focused approach.

This quarter, the emphasis has noticeably shifted to completing ongoing projects and refining delivery standards rather than aggressively adding to supply. The tempered pace of new launches reflects a maturing market— one where supply is increasingly aligned with end-user demand and decisions are made with a sharper eye on prevailing global uncertainties.