NAREDCO Maharashtra to hold ‘The Real Estate Forum 2024’ on Aug 29.

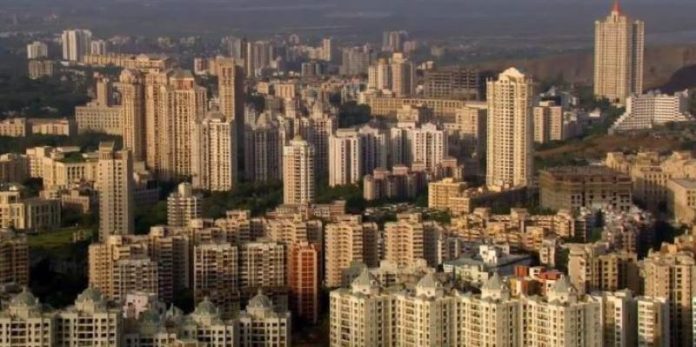

MUMBAI, Aug 21 (The CONNECT) – The National Real Estate Development Council (NAREDCO), Maharashtra Chapter, is set to host its flagship event, The Real Estate Forum (TREF) 2024 with JLL as their knowledge partner on August 29, 2024

Maharashtra Chief Minister of Maharashtra Eknath Shinde, Deputy Chief Minister Devendra Fadnavis and Housing Minister Atul Save will address the event. This year’s edition is expected to gather over 500 delegates from the real estate sector, providing a platform to explore the latest trends, innovations, and opportunities that the sector presents. Additionally, JLL will unveil a white paper during the event, offering key insights into the industry.

Prashant Sharma, President of NAREDCO Maharashtra, said the forum is designed to deal with the pressing challenges and opportunities offered in the real estate sector.

Dr. Samantak Das, Chief Economist and Head of Research and REIS, India, JLL said, as Mumbai continues to expand, the completion of key transit infrastructure projects and the upcoming Navi Mumbai Airport promise to drive significant growth in both residential and commercial sectors, propelling the city’s real estate market towards unprecedented levels of activity and value.

Mumbai’s residential sales value is projected to surpass INR 1.35 lakh crore in 2024 and grow at a CAGR of ~6.8% to reach over INR 2 lakh crore by 2030. Developers have already acquired over 280 acres of land, translating to a development potential of approximately 42-48 million sq ft and a sales potential of approx. INR 70,000 crore, he said.

The Real Estate Forum 2024 will feature an array of speakers, panel discussions, and interactive workshops and the discussion topics will include government policies that drive real estate, the diversity of the residential market, challenges and opportunities in redevelopment, trends in real estate financing, and necessary amendments to RERA 2.0.