RBI guv invokes Mahatma Gandhi: The slightest error of judgment, a hasty action or a hasty word may put back the hands of the clock of progress.

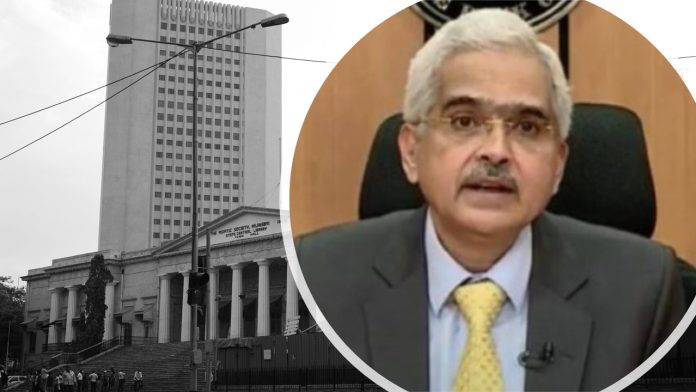

MUMBAI, Aug 8 (The CONNECT) – The Monetary Policy Committee (MPC) of the Reserve of India (RBI) has decided by 4-2 majority not to change the repo rate of 6.5 in view of the food inflationary pressure.

Under the current monetary policy setting, inflation and growth are evolving in a balanced manner and overall macroeconomic conditions are stable, said RBI governor Shaktikanta Das.

Growth remains resilient, inflation has been trending downward and we have made progress in achieving price stability; but we have more distance to cover. The progress towards our goal of price stability has been uneven due to large and persistent supply side shocks, especially in food items, he said.

“We, therefore, need to remain vigilant to ensure that inflation moves sustainably towards the target, while supporting growth. This approach would be net positive for sustained high growth,” he said

And quoted Mahatma Gandhi: “The slightest error of judgment, a hasty action or a hasty word may put back the hands of the clock of progress. Policies have, therefore, to be cautiously evolved…”55

Headline inflation, after remaining steady at 4.8 per cent during April and May 2024, increased to 5.1 per cent in June 2024, primarily driven by the food component, which remains stubborn. Core inflation (CPI excluding food and fuel) moderated, while the fuel group remained in deflation.

The expected moderation in headline inflation during the second quarter of 2024-25 on account of favourable base effects is likely to reverse in the third quarter. Domestic growth, however, is holding up well on the back of steady urban consumption and improving rural consumption, coupled with strong investment demand.

Amidst this confluence of factors, the MPC judged that it is important for monetary policy to stay the course while maintaining a close vigil on the inflation trajectory and the risks thereof. Resilient and steady growth in GDP enables monetary policy to focus unambiguously on inflation. It must continue to be disinflationary and resolute in its commitment to aligning inflation to the target of 4.0 per cent on a durable basis.

Accordingly, the MPC decided to keep the policy repo rate unchanged at 6.50 per cent in this meeting. The commitment of monetary policy to ensure price stability would strengthen the foundations for a sustained period of high growth. Hence, the MPC reiterated the need to continue with the disinflationary stance of withdrawal of accommodation to ensure that inflation progressively aligns to the target, while supporting growth.