Demand for residential, commercial, education and healthcare, villa projects and plotted developments, mixed-use, industrial, and data centres.

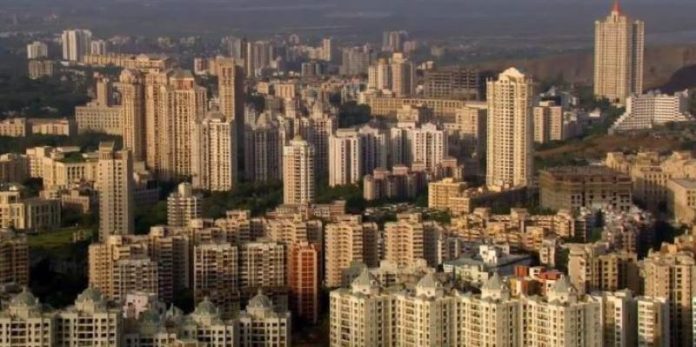

MUMBAI, Jan 17 (THe CONNECT)- Financially strong developers and other entities continued to acquire land in 2024 despite escalating land prices. MMR led in terms of land deal sizes, while NCR saw the greatest number of land deals closed among all cities.

Anuj Puri, Chairman – ANAROCK Group, said, “The highest land areas transacted in 2024 were in MMR, with 607+ acres in 30 separate transactions. This accounted for over 24% of the total land transacted. Residential, commercial, education and healthcare, villa projects and plotted developments, mixed-use, industrial, and data centres are among the planned developments. In total, there were at least 133 separate land deals for over 2,515 acres closed in 2024 across the country”.

Land Deals in 2024

- Of 133 land deals closed in 2024, 95 deals for approx. 1,948 acres are proposed for residential development across tier 1, 2 and 3 cities

- 97+ acres in 4 separate deals are earmarked for Industrial & Logistic Parks

- 5 deals for 124+ acres are for mixed-use developments

- 12 deals for approx. 175 acres are for commercial spaces and data centres

- 78+ acres in 12 separate deals are earmarked for retail, education & healthcare, agriculture, senior living and other asset classes

- Development purpose for 5 deals spanning approx. 93 acres is still undecided

|

Proposed Development |

No. of Land Deals |

Approx. Size (acres) |

|

Residential including plotted development & Township Project & Luxury Villas with 5-star Hotel |

95 |

1947.86 |

|

Industrial & Logistics |

4 |

97.32 |

|

Mixed-Use |

5 |

124.14 |

|

Commercial & Data Centre |

12 |

174.8 |

|

Retail |

3 |

14.13 |

|

Education & Healthcare |

6 |

13.38 |

|

Agriculture |

1 |

18 |

|

Senior Living |

2 |

32.5 |

|

Not Decided Yet |

5 |

92.67 |

|

Total |

133 |

2514.8 |

Source: ANAROCK Research

City-wise Breakup

“MMR and NCR saw the most land acquisition in 2024,” adds Puri. “MMR saw the highest land volumes transacted with over 607 acres in 30 deals, while NCR led in deal numbers – 38 deals for over 417 acres. Land prices in both the regions have skyrocketed over the last few years, but this has not deterred developers from zeroing in one prime assets in these regions.”

|

Top 7 Cities |

||||||

|

Cities |

No. of Deals |

Approx. Size (acres) |

||||

|

NCR |

38 |

417.11 |

||||

|

MMR |

30 |

607.03 |

||||

|

Bengaluru |

26 |

307.53 |

||||

|

Hyderabad |

4 |

67.1 |

||||

|

Pune |

8 |

63.22 |

||||

|

Chennai |

7 |

69.07 |

||||

|

Kolkata |

1 |

53 |

||||

|

Tier 2 & 3 Cities |

||||||

|

Cities |

No. of Deals |

Approx. Size (acres) |

||||

|

Ahmedabad |

3 |

44.37 |

||||

|

Amritsar |

1 |

45 |

||||

|

Andhra Pradesh |

1 |

25 |

||||

|

Ayodhya |

1 |

51 |

||||

|

Coimbatore |

1 |

9.03 |

||||

|

Dholera |

1 |

50 |

||||

|

Indore |

1 |

46 |

||||

|

Jaipur |

2 |

22.2 |

||||

|

Ludhiana |

1 |

59 |

||||

|

Mohali |

1 |

13.14 |

||||

|

Nagpur |

1 |

100 |

||||

|

Shimla |

1 |

11 |

||||

|

Sonipat |

1 |

20 |

||||

|

Surat |

1 |

300 |

||||

|

Varanasi |

1 |

75 |

||||

|

Vrindavan |

1 |

60 |

||||

|

Total |

133 |

2514.8 |

||||

Source: ANAROCK Research

|

Top Land Deals Across Cities in 2024 |

|||||

|

Deal in Quarter |

Buyer |

City |

Approx. Size (in Acres) |

Approx. Value (INR-crore) |

Proposed Development |

|

Q1-2024 |

DLF Homes Developers |

Gurgaon |

29 |

825 |

Residential |

|

Q1-2024 |

Arvind Smartspace |

Surat |

300 |

JDA |

Plotted Development |

|

Q1-2024 |

Adani Realty |

Mumbai |

24 |

8000 cr (or 23.5% revenue share) |

Commercial |

|

Q1-2024 |

Godrej Properties |

Bengaluru |

62 |

Profit Sharing |

Township Project |

|

Q1-2024 |

Prestige Group |

Ghaziabad |

62.5 |

468 |

Township Project |

|

Q2-2024 |

Sumadhura Group |

Bengaluru |

40 |

800 |

Residential |

|

Q2-2024 |

Signature Global |

Gurgaon |

14.65 |

350 |

Residential |

|

Q2-2024 |

Microsoft |

Hyderabad |

48 |

267 |

Data Centre |

|

Q2-2024 |

ESR India |

Chennai |

27 |

276 |

Logistic Park |

|

Q3-2024 |

Keystones Realtors |

Thane |

88 |

91 |

Plotted Development |

|

Q3-2024 |

JMS Group |

Gurgaon |

6.5 |

300 |

Residential |

|

Q3-2024 |

Astrea (The Phoenix Mills) |

Coimbatore |

9.03 |

370.17 |

Retail |

|

Q3-2024 |

Century Real Estate (Aditya Birla Real Estate) |

Mumbai |

10 |

1100 |

Residential |

|

Q4-2024 |

AAIJI Group |

Dholera, Gujarat |

50 |

70 |

Residential (Luxury Villas) |

|

Q4-2024 |

Mahindra Life spaces |

Mumbai |

37 |

JDA |

Mixed Use |

|

Q4-2024 |

Macrotech Developers (Lodha) |

Sohna, Gurgaon |

45 |

110 |

Industrial & Logistic Park |

|

Q4-2024 |

House of Abhinandan Lodha (HoABL) |

Varanasi |

75 |

250 |

Plotted Development |

Source: ANAROCK Research

- MMR saw the highest land area transacted – 607+ acres in 30 separate deals – and accounted for over 24% of the total land transacted in 2024. The planned developments include residential, commercial, education & healthcare, villaments and plotted developments, mixed-use, industrial and data centers.

- NCR saw the highest number of deals (38) for approx. 417 acres, earmarked largely for residential (31), 3 deals for commercial projects, 2 for Industrial & Logistics Parks, and 1 deal each for agricultural and educational developments. City-wise, there were 24 deals – 273.04 acres in Gurugram, 9 deals for a total o