Govt has laid the foundation for inclusive growth and a robust, consumption-led economy, they say

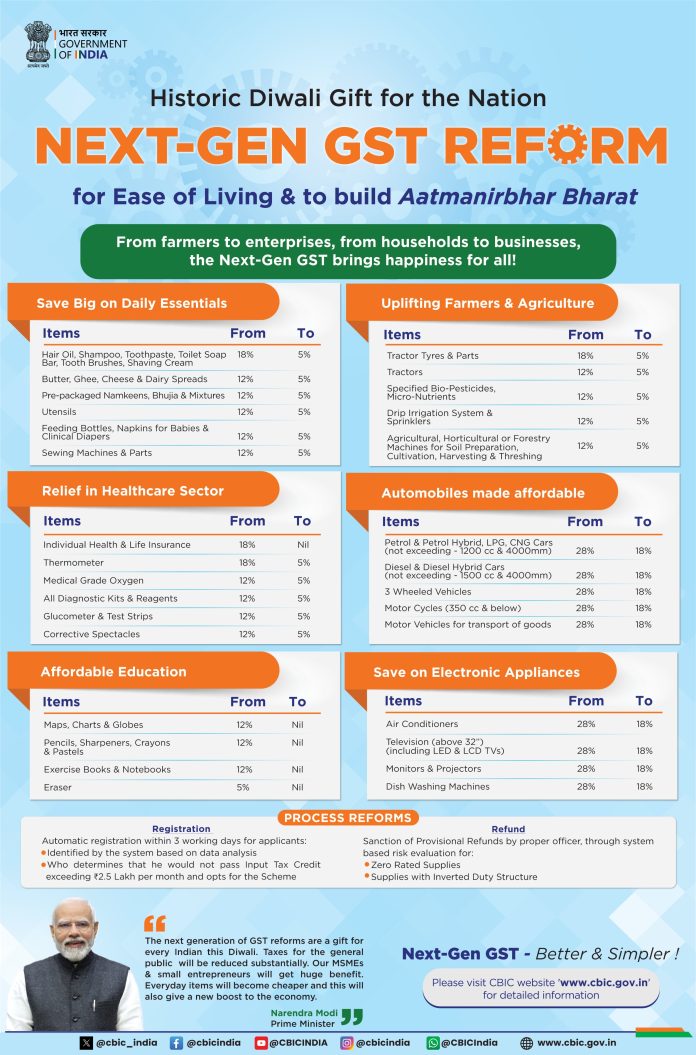

MUMBAI, Sep 4 (The CONNECT) – The 56th meeting of the Goods and Services Tax (GST) Council has approved the reforms that were announced by Prime Minister Narendra Modi on the Independence Day.

These reforms are being considered landmark as they focus on providing major relief to the common man of India by reducing the tax burden on essential goods and services, simplifying compliance for businesses, and promoting overall economic growth.

Business community across sectors has welcomed the move enthusiastically. Experts have particularly noted that the reduction of GST from 28% to 18% on cement and marbles, and from 12% to 5% on granite blocks, would lead to an overall decrease in the final cost of housing units, benefiting homebuyers significantly.

Anuj Puri, Chairman – ANAROCK Group, said the GST changes, which will go into effect from September 22, 2025, will have a positive impact on the Indian residential, retail, and office real estate sectors.

Reduced GST on construction materials like cement can save construction costs by as much as 3-5%. Developers, especially those engages in creating affordable housing, will get major relief in terms of cash flows and margins, Puri said.

ANAROCK Research reveals that the affordable housing category (below Rs 40 lakh) has seen its share of total sales decline from 38% in 2019 to just 18% in 2024. The share of new supply dropped even more dramatically from 40% in 2019 to just 12% in H1 2025. The reduced construction costs, if passed on to homebuyers, can boost demand in these segments.

The simplified GST structure does away with the old five-slab system and now has only two primary slabs of 5% and 18%, in addition to a 40% rate on luxury and so-called ‘sin goods’. The resultant pricing clarity will go a long way in improving overall consumer confidence. The simplified framework will make the tax implications of buying homes clearer and this clarity can potentially bring significant numbers of first-time buyers and fence-sitters to the market. This would have an especially notable impact in tier-II and tier-III cities, he said.

Commercial real estate currently attracts 12% GST with Input Tax Credit (ITC) available. However, recent developments have complicated the landscape a bit. The elimination of ITC on commercial property leasing implies that developers will no longer be able to claim ITC on project-related costs. This retrospective amendment may increase operational costs and rental prices for office spaces and other commercial properties.

The Reverse Charge Mechanism (RCM) for commercial property rentals by unregistered suppliers, which requires tenants rather than landlords to pay 18% GST on such rentals, adds compliance burden for businesses renting commercial spaces.

The reduced GST on building materials will result in lower input costs for developers and help speed up the supply of retail real estate projects. Since shopping centres and retail complexes will now incur reduced construction costs, this may result in more competitive rental rates.

The GST rationalization will bring down logistics costs and help streamline supply chains, benefiting retail real estate operations. However, retail properties used for commercial purposes will continue to attract 18% GST on rental income.

Pradeep Aggarwal, Founder & Chairman, Signature Global (India) Ltd. wholeheartedly welcome the GST Council’s move on rate rationalisation ahead of the festive season. By reducing the tax burden, the move comes as a major relief for the common man. The housing sector, particularly, stands to benefit from GST reduction on input materials like cement from 28% to 18% and granite blocks from 12% to 5%, as this will ultimately reduce home prices for consumers and create sustainable demand across segments, he said.

Ashok Kapur, Chairman, Krishna Group and Krisumi Corporation, said, “The GST Council’s decision to approve the implementation of next-generation GST reforms is a crucial step towards simplifying India’s tax structure and boosting economic growth. For real estate, these reforms are particularly significant as they will directly benefit from reduced taxes on raw materials like cement and marble blocks, lowering the cost of constructing homes, ensuring easier compliance for developers, and improving overall affordability for homebuyers.”

Sumit Agarwal, Director, Ashtech Group, said, “The government’s move to reduce GST on cement, marble, and other key inputs will significantly reduce construction costs in both real estate and infrastructure. This is a significant step that is expected to not only ease the burden on developers but also stimulate demand and give a strong boost to the industry as a whole.”

Vikas Bhasin, Managing Director, Saya Group, said, “We welcome the government’s decision on broad GST rate rationalization, which will benefit the public at large.

The reduction of GST on cement is also a positive step and will help ease construction costs. However, it is important to note that construction materials account for only about 25–30% of the overall cost of real estate projects, and cement is just one of the many inputs. Therefore, the impact of this move on end prices will be limited.”

Deepak Kumar Jain, Founder and CEO of TaxManager.in, said, “Real estate, being one of the most labour-intensive sectors, is expected to gain significantly from the reduction of GST rates—from 28% to 18%—on key construction materials such as cement, tiles, and other inputs. This move will help lower overall construction costs to some extent. It is also expected that developers will pass on these benefits to homebuyers by reducing property prices, which have risen sharply over the past few years.”

Arjun Bajaj, Director of Videotex: the new GST regime move will not only boost sales but also encourage consumers to upgrade to larger screen sizes. With tax cuts on other items as well, disposable incomes are set to rise, enhancing buying power and supporting overall economic growth. Announced during the festive season, the step is especially impactful as it makes advanced home entertainment more accessible. We foresee a clear shift in demand from 32-inch models to popular sizes like 40, 43, and 55 inches—expanding the market and improving consumer lifestyles.

Trideep Bhattacharya, President and CIO- Equities Edelweiss MF said “GST 2.0 marks a defining reset for India’s consumption story. By rationalising slabs and lowering rates on mass categories while taxing sin goods higher, the Council has unlocked volume tailwinds for staples, durables and autos—reshaping equity market leadership in the coming years.”

FADA President C S Vigneshwar too welcomed the bold and progressive reforms which simplify the tax structure, lower rates for mass mobility, and bring consensus across all States. This is a decisive step that will boost affordability, spur demand, and make India’s mobility ecosystem stronger and more inclusive.

He thanked the PM, the Finance Minister and the GST Council for taking such a courageous decision with unanimity. As the country heads into the peak festive season, glitch-free implementation will be the key to ensuring that the benefits seamlessly reach customers. One area that may needs earliest clarification is about levy and treatment of cess balances currently lying in dealers’ books, so that there is no ambiguity during transition.

Unsoo Kim, Managing Director, Hyundai Motor India: welcomed the landmark GST reforms announced by the Government of India. This revolutionary step will provide a strong impetus to the Indian economy, enhance buoyancy and further strengthen consumer confidence.

By reducing the tax burden on essential goods, the Government has laid the foundation for inclusive growth and a robust, consumption-led economy.

The GST overhaul will directly benefit the automotive sector. The announced reforms align seamlessly with the Government’s commitment to Viksit Bharat and the Make in India initiative, encouraging domestic manufacturing and boosting demand across both urban and rural markets.

Notably, 60% of our ICE portfolio will now fall under the 18% slab rate, with the remainder at 40%.

Mukesh Pandey, Director of Rupyaa Paisa said GST 2.0 represents one of the largest reforms in taxation since the initial introduction of GST in 2017. Its implications for India’s MSMEs could be revolutionary. For many years, small companies suffered from overly complex tax structures, delays in refunds, and compliance burdens that consumed time and working capital. The new dual slab of 5 per cent and 18 per cent provided clarity on the classification issue and invoicing however; we are working to ameliorate classification issues. For MSMEs this could mean less legal battles, higher efficiency and increased buyer demand as several products are now more affordably classified. India’s 6.4 crore MSMEs employing more than 11 crore people are the engine of our economy. If GST 2.0 is implemented effectively, it will not only lower the cost of compliance, but improve competitiveness and have small businesses better positioned to succeed domestically and internationally.

Rakesh Goyal, Director, Probus, said the GST relief on individual health and life insurance premiums goes far beyond numbers, it is a decisive step towards making insurance more accessible and India more protection oriented. For decades, affordability has been one of the biggest barriers to insurance penetration, and by easing the cost burden, this move directly addresses that concern.

Policyholders will experience immediate relief, which we believe will encourage wider insurance uptake across households and middle-income segments and improve persistency among existing customers.

At the same time, as an industry we must acknowledge that the absence of input tax credit could add cost pressures on insurers. However, with greater volumes and wider adoption, the long-term benefits far outweigh the short-term challenges.

What we are witnessing is not just a tax change, this reform has the potential to significantly accelerate the journey of insurance from being a product of choice to a product of necessity.

Gaurav Markanda, CEO & Co-Founder, Let’s Konstruct, said Lower GST on cement, combined with reductions on other materials (e.g., from 12% to 5% on certain inputs), will directly cut project costs for roads, bridges, and public works. This supports government initiatives like highways and urban development, potentially accelerating timelines and increasing investment in infra projects. The reduction is a major relief for the housing sector, especially affordable housing, by lowering construction costs and making properties more price-competitive.

The GST cut is broadly welcomed as a pro-growth measure that eases costs without significant fiscal trade-offs, fostering a positive outlook for the cement sector while catalyzing activity in infrastructure and real estate. If prices are fully passed on, it could contribute to broader economic momentum.

Prashant Sharma, President, NAREDCO Maharashtra said, “NAREDCO Maharashtra welcomes the GST slab rationalization rolled out effective September 22, 2025. Bringing essential construction materials—particularly cement—from 28% down to 18%, and materials like granite and sand-lime bricks to 5%, delivers significant cost relief across the construction value chain. This reduction eases input costs, improves project feasibility, and allows developers to pass savings on to homebuyers—especially in the affordable housing segment. Announced during the festive season, this move not only uplifts consumer sentiment but also aligns with the Government’s ‘Housing for All’ mission.”

Kaushal Agarwal, Chairman, The Guardians Real Estate Advisory said, “The shift to a two-slab GST regime (5% and 18%) coupled with the reduction on key inputs is a welcome structural reform. Simplified taxation not only streamlines compliance, but enables faster project execution. For buyers, this could translate into more accessible pricing and improved transparency. The timing is strategic—just ahead of the festival season—setting the stage for renewed buyer interest and a healthier real estate cycle.”

Vikas Jain, CEO, Labdhi Lifestyle & President, NAREDCO Maharashtra NextGen said, “The GST rationalization is a landmark move by the Government. The reduction in GST on construction materials will help ease the cost pressures on developers, especially in affordable and mid-segment housing. Simplifying tax slabs also brings much-needed clarity and predictability—essential for innovation in design, sustainable developments, and faster deliveries. If suppliers pass on these savings, homebuyers stand to benefit considerably.”

Navin Makhija, Managing Director, The Wadhwa Group said, “The GST reform is not just a tax tweak—it’s a strategic stimulus for the entire economy. Lower GST on cement and other finishing materials will help reduce construction costs, enabling developers to pass on the benefits to homebuyers. Reduction of GST on almost 80% of the products will leave a greater spending power in the hands of consumers, their ability to buy and borrow improves, which will naturally fuel housing demand and the economy in general. This reform is well-timed to boost sentiment and drive deeper housing penetration across emerging micro-markets.”

Shraddha Kedia-Agarwal, Director, Transcon Developers said, “This rationalization of GST is a milestone decision that eases cost burdens for developers and promises relief for homebuyers. With construction costs shrinking, there’s scope to reimagine offerings—perhaps through more thoughtfully priced units or upgraded amenities that maintain affordability. Crucially, the simplification assures buyers about transparency in overall tax burdens, which can restore trust and strengthen market sentiment.”

Gagan Sharma, Managing Director of XElectron, opined that the GST 2.0 is a welcome step for both consumers and brands like ours. It not only reduces the cost burden of purchasing lifestyle electronics such as TVs and projectors but also encourages customers to opt for higher-end, larger-screen models that are often considered luxury items. The timing makes this move even more impactful, as the revised rates will come into effect during the festive season, when people actively purchase and gift electronics, giving a boost to the consumer electronics market. At XElectron, we offer innovative products such as smart projectors, LED TVs, digital photo frames, and monitors, and this change ensures that consumers can now enjoy them at even more attractive prices, especially for festive gifting.”

Vimal Nadar, Senior Director & Head of Research, Colliers India, said The newly announced two-slab GST structure of 5% and 18% is a progressive move to rationalize the prevailing inverted duty structure, improvise classification, simplify approvals & processing refunds. These measures will surely cut costs at different tiers while enhancing the ease of doing business and driving consumption.

Within real estate, the slashing of GST on cement will play a critical role in rehauling project cost structures as cement forms a major value component in the overall cost of construction. Residential real estate, particularly new homebuyers, stand to gain as developers are likely to pass on the benefit of lower costs in the form of reduced housing prices. Developers’ profitability margins, too can potentially improve, enhancing the overall financial health of the real estate sector. The timing of this rollout is appropriate, with the festive season in the offing and the real estate sector is already reaping the benefits of favourable interest rates.

Piyush Bothra, Co-Founder and CFO, Square Yards,said The latest GST restructuring comes as a major boost for the real estate sector. With the reduction in costs of key construction materials such as cement and steel, input expenses for developers are expected to ease, making projects more viable. The move towards a simplified two-slab structure will also streamline compliance, making processes smoother and faster. For the residential segment, this is likely to translate into tangible benefits for homebuyers as developers pass on the savings over the coming months. While the impact may take some time to reflect, it could provide much-needed relief in the backdrop of rising property prices and add to overall affordability. Coupled with the optimism of the upcoming festive season, these reforms are well placed to drive stronger demand in the property market.

Shrinivas Rao, FRICS, CEO, Vestian,siad, The recent reduction in GST rates is poised to strengthen the real estate sector by reshaping demand–supply dynamics. Lower GST on construction materials is expected to enhance housing affordability by reducing input costs, while reduced GST on other goods could improve disposable income, thereby stimulating real estate demand. However, the overall impact may remain limited if these savings are not adequately passed on to end-consumers.”

Upasna Bhardwaj, Chief Economist, Kotak Mahindra Bank, said the GST rationalisation goes a long way in supporting the consumer demand and cushioning the downside risk to growth emanating from the tariff related uncertainties. The income tax cuts and GST rate cuts if fully passed through could potentially provide a stimulus of 0.6% of GDP on a pro rata basis in FY26 itself. Furthermore, the full pass through of GST cut could create disinflationary impact of atleast 100 bps.”