Realtors Murmur, EMIs May Shoot

Realtors have chosen to give guarded reaction to RBI hiking the repo rate which could shoot EMIs and impact first time buyer sentiment.

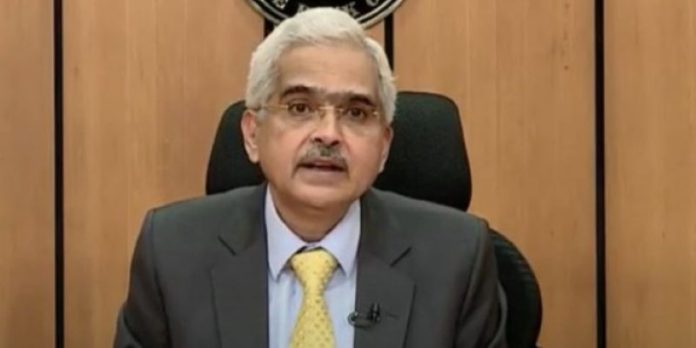

MUMBAI: The Reserve Bank of India (RBI) Governor Shaktikanta Das announced the Monetary Policy statement on February 8, 2023, increasing the repo rate by 25 bps as widely expected. The repo rate hike will undoubtedly push up the home loan interest rates, which had already crept up after five consecutive rate hikes this year.

Here are some reactions from realors:

Sandeep Runwal – President, NAREDCO Maharashtra: The RBI’s decision to hike the interest rate by 25 basis points to 6.50 percent will keep inflation in check and on target. This hike has been on expected lines, and is only taking forward the government’s budget initiatives, of sustainable growth and financial stability.

This hike in interest rate will not affect home buyer sentiments much, as there is a strong demand for housing.

The recent positive budget announcements which aim at putting more money into the hands of the home buyer, will fuel demand. This coupled with the additional outlay provided in the PMAY will give a definite thrust to the mission of providing housing for all.

Overall, the RBI policy announcement has tried to rein in inflation, but at the same time balance the growth process of the economy. The Indian economy is resilient to global headwinds and has fared remarkably well.

Kaushal Agarwal – Chairman, The Guardians Real Estate Advisory: Consecutive rate hikes by the RBI this year were aimed at re-anchoring the inflation expectations and maintaining financial stability. Thus far, the rising cost of house ownership led by higher EMI, higher stamp duty and other factors has not affected real estate sales, which is a firm indicator of genuine demand for housing. But any further hike in the repo rate might temporarily limit the growth momentum of the real estate sector. Although the recently concluded budget was tailor-made keeping the salaried and the middle class in mind, a rate cut at this stage could have triggered the sentiments of the homebuyers sustaining the growth momentum.

Pritam Chivukula – Co-Founder & Director, Tridhaatu Realty and Treasurer, CREDAI MCHI: RBI ‘s decision to hike the interest rates to tackle the inflation and ensure domestic economic recovery was a no-brainer. But a rate cut would have been a big booster for the real estate sector which was overlooked in the recently concluded budget. The sharp acceleration of rates consecutively for the sixth time in a short period will have a short-term effect on the sentiment of homebuyers as low interest rates have been the biggest factor in the resurgence for real estate demand in the last two years. We hope that the State Government will step-in again to lighten the homebuyer’s load by reducing stamp duty to boost the sentiments.

Himanshu Jain, VP – Sales, Marketing and CRM, Satellite Developers Pvt. Ltd. (SDPL): Keeping the current market conditions and inflation in mind, the move by the RBI was expected to keep the economy on the track in the current highly volatile scenario. The rising property prices had already added to the woes of the homebuyers and now the decision of RBI to increase the repo rate will temporarily dent the current demand momentum. Also, for first-time home buyers, acquiring a home is considered as the biggest asset and these short-term decisions are likely to have a major impact on a buyer’s decision.

Bhushan Nemlekar, Director, Sumit Woods Limited: Earlier, due to the pandemic and the geopolitical issues, the input costs were already high and now with these consecutive rate hikes, it will only dampen the spirit of the entire real estate value chain. The cost of borrowing for both developers and buyers will be impacted and this will result in undesired rate hikes across the spectrum. However, we did not see much impact on the buying spree in the last couple of quarters since there are genuine buyers in the market to keep the momentum going.

Dr. Sachin Chopda, Managing Director, Pushpam Group: RBI’s decision to hike the policy repo rate was anticipated, factoring the rise in inflation. The rate hike is likely to shrink liquidity in the economy overall, especially impacting the investor’s sentiments. There will be a short-term pause on the minds of the investors while assessing the volatility of the current market dynamics. However, they are bound to return soon in the market once it is stable.

Amit Goyal, CEO, India Sotheby’s International Realty: The rate hike of quarter basis point by the central bank is on expected lines. Inflation is still above RBIs comfort levels and considering the evolving inflation outlook, it’s important to ensure inflation remains within the tolerance band and progressively aligns with the target. The good news is that amid volatile global developments, the Indian economy remains resilient and is expected to grow at 7% in FY23.

While an increase in repo rate will certainly increase the home loan interest rates, we are optimistic and expect the housing demand to remain intact.

V Swaminathan, Executive Chairman, Andromeda Sales and Apnapaisa.com, (India’s largest loan distributors): Repo rate is directly linked to loan rates offered by lenders so an increase in the repo will increase the borrowing cost and vice-versa. The rate hike of 25 bps today will make EMIs expensive by approx 2-4%. Borrowers will either have to shell out extra money to repay their loans or will have to extend their tenure.

Pradeep Aggarwal, Founder and Chairman, Signature Global (India) Ltd: The increase of repo rate by 25 bps the apex bank is aimed to give an extra cushion to curb inflation in the face of geopolitical uncertainties. It is an accommodative move as per current micro and macro-economic conditions globally as well as domestic markets. Controlling inflation is the RBI’s mandate, and the apex bank is showing prudence in taking corrective measures to curb rising inflation.

However, considering the growth focused fiscal budget announced by the Government earlier this month, combined with the positive market sentiments, it is quite evident that the affordable and mid segment housing is going to witness a significant upsurge in demand in the coming months. We are confident that residential sales would increase at least 20 percent in this quarter and at least 30 percent on YOY basis overall.

Saransh Trehan, Managing Director, Trehan Group: With the latest increase in repo rate, home loan rates will cross the level of 9% per annum. So far, the demand in the housing sector remained unimpacted with past increase, but any further hike in interest rate will certainly put a break on the demand in the housing sector.