Co Raises Rs 147 Cr From Anchor Investors

Broking houses see it as a great opportunity to invest as Rishabh is a well-established company with a history of growth and innovation.

MUMBAI, Aug 30 (The CONNECT) – The Initial Public Offering of Rishabh Instruments Limited, a global energy efficiency solution company, was subscribed 73% today, the first day of bidding.

The issue received bids of 56,75,008 shares against the offered 77,90,202 equity shares, at a price band of ₹418-441, according to the data available on the stock exchanges.

The Non-Institutional Investors segment was fully subscribed, Retail Portion was subscribed with 92%, whereas the QIBs chipped in 1%. The issue is open till Friday, September 1, 2023.

The company raised Rs 147 crore from anchor investors yesterday. Foreign Investors and Domestic Institutions who participated in the anchor were HDFC Mutual Fund, Nippon India Mutual Fund, Sundaram Mutual Fund, Bandhan Mutual Fund, Quant Mutual Fund, Tata Mutual Fund, Ashoka India Equity Investment Trust PLC, Aditya Birla Sun Life Insurance Company and 3P India Equity Fund 1.

Broking houses like SBI Securities, Arihant Capital, Anand Rathi, Marwadi Financial Services and Sushil Finance have given a “SUBSCRIBE” rating to the issue, citing its domestic and global leadership in select products, technology driven vertically integrated facilities, export-oriented business operations and its diverse clientele and product portfolio. The broking houses are also positive about the huge addressable market of the company’s various products and is expected to benefit from mega industrialization trends.

The broking houses, however, noted that the valuation is higher but given the growth prospects, they believe it is a great opportunity to invest in a well-established company with a history of growth and innovation.

DAM Capital Advisors Limited, Mirae Asset Capital Markets (India) Private Limited and Motilal Oswal Investment Advisors Limited are the book running lead managers to the offer and KFin Technologies Limited is the Registrar to the Offer. The Equity Shares are proposed to be listed on BSE Limited and National Stock Exchange (NSE).

Company Information: Founded by Narendra Joharimal Goliya in 1982, Rishabh Instruments supplies a wide range of electrical measurement and process optimization equipment.

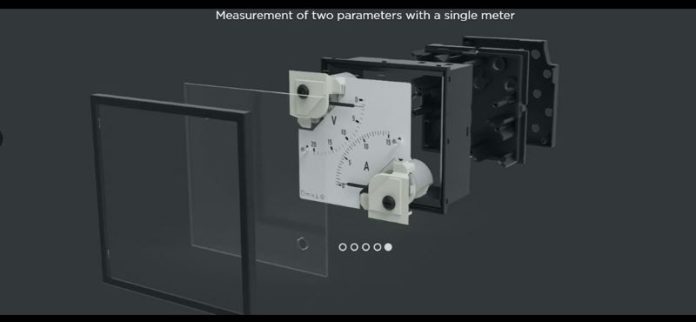

It is a vertically integrated player involved in designing, developing, manufacturing and supplying electrical automation devices; metering, control and protection devices; portable test and measuring instruments; and solar string inverters. Through its subsidiary, Lumel Alucast, it manufactures and supplies high pressure die cast aluminum components to the automation and automotive industry mainly in Europe.

According to the F&S report mentioned in the Red Herring Prospectus, the Company is a global leader in the manufacture and supply of analog panel meters and is also one of the leading global manufacturers and suppliers of low voltage current transformers. For meters, controllers, and recorders, Lumel is the most popular brand in Poland, and Lumel Alucast is one of the leading non-ferrous pressure casting players in Europe.

Rishabh Instruments’ revenue from operations increased by 21.11% from Rs 470.25 crore in Fiscal 2022 to Rs 569.54 crore in Fiscal 2023, primarily driven by increase in revenue from sale of goods and from sale of services, whereas profit grew to Rs 49.69 crore in Fiscal 2023, as compared to Rs 49.65 crore in Fiscal 2022.