Trump Impact? RBI governor says “rising tendencies of protectionism” have the potential to undermine global growth and push inflation higher.

By B N KUMAR

MUMBAI, Dec 6 (The CONNECT) – The Reserve Bank of India has decided to keep the interest rate regime unchanged citing the above tolerance level inflationary pressures and the unexpected drop in the GDP.

Without referring to the likely impact of the Donald Tump capturing power in the US, the central bank apprehended that going forward, the outlook is clouded by “rising tendencies of protectionism” which have the potential to undermine global growth and push inflation higher.

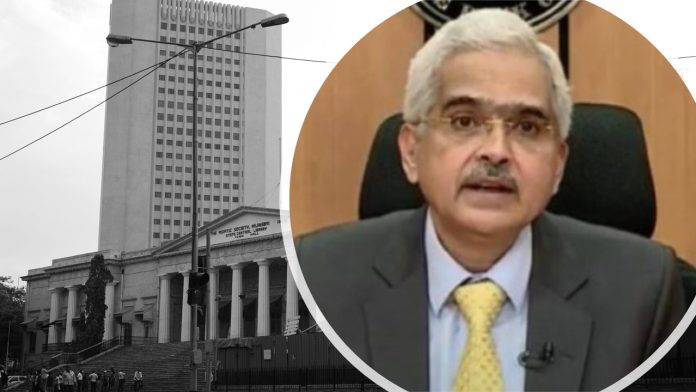

The Monetary Policy Committee (MPC) at the end of its three-day meeting, today decided by a 4 to 2 majority to keep the policy repo rate unchanged at 6.5 per cent. Consequently, the standing deposit facility (SDF) rate remains at 6.25 per cent and the marginal standing facility (MSF) rate and the Bank Rate at 6.75 per cent, RBI Governor Shakti Kanda Das said. The MPC also decided unanimously to continue with the ‘neutral’ stance and to remain unambiguously focused on a durable alignment of inflation with the target, while supporting growth.

High inflation reduces the disposable income in the hands of consumers and dents private consumption, which negatively impacts the real Gross Domestic Product (GDP) growth, Das observed.

The MPC took note of the recent slowdown in the growth momentum, which translates into a downward revision in the growth forecast for the current year.

Going forward into the second half of this year and the next year, the MPC assessed the growth outlook to be resilient, but warranting close monitoring.

Inflation, on the other hand, surged above the upper tolerance band of 6.0 per cent in October, driven by a sharp uptick in food inflation.

Inflation increased sharply in September and October 2024 led by an unanticipated increase in food prices. Core inflation, though at subdued levels, also registered a pick-up in October. Fuel group remained in deflation for the 14th consecutive month in October.

In the near term, despite some softening, lingering food price pressures are likely to keep headline inflation elevated in Q3.

Food inflation pressures are likely to linger in Q3 of this financial year and start easing only from Q4:2024-25, backed by seasonal correction in vegetables prices, kharif harvest arrivals, likely good rabi output and adequate cereal buffer stocks.

The increasing incidence of adverse weather events, heightened geo-political uncertainties and financial market volatility pose upside risks to inflation. The MPC believes that only with durable price stability can strong foundations be secured for high growth.

The last mile of disinflation is turning out to be prolonged and arduous, both for advanced and emerging market economies (EMEs). Maintaining macroeconomic and financial stability, and building buffers, continue to be the lodestar for the EMEs.

Growth in real GDP in Q2 at 5.4 per cent turned out to be much lower than anticipated. This decline in growth was led mainly by a substantial deceleration in industrial growth from 7.4 per cent in Q1 to 2.1 per cent in Q2 due to subdued performance of manufacturing companies, contraction in mining activity and lower electricity demand. The weakness in the manufacturing sector, however, was not broad-based but was limited to specific sectors such as petroleum products, iron and steel and cement.

Going forward, high frequency indicators available so far suggest that the slowdown in domestic economic activity bottomed out in Q2:2024-25, and has since recovered, aided by strong festive demand and pick up in rural activities. Agricultural growth is supported by healthy kharif crop production, higher reservoir levels and better rabi sowing.

Industrial activity is expected to normalise and recover from the lows of the previous quarter.12 The end of the monsoon season and the expected pick up in government capital expenditure may provide some impetus to cement and iron and steel sectors.

Mining and electricity are also expected to normalise post the monsoon-related disruptions. The purchasing managers’ index (PMI) for manufacturing at 56.5 for November remained elevated. The supply chain pressures eased in October-November and fell below the historical average.

The services sector continues to grow at a strong pace. PMI services remained steady at 58.4 in November, indicating continued expansion.

Das pointed out that the world today is characterised by intricate complexities and profound uncertainties.

“ As a central bank, our job is that of an anchor of stability and confidence, which would ensure that the economy achieves sustained high growth,” he said.

Since the last policy, inflation has been on the upside, while there has been a moderation in growth. Accordingly, the MPC has adopted a prudent and cautious approach in this meeting to wait for better visibility on the growth and inflation outlook. At such a critical juncture, prudence, practicality and timing of decisions become even more critical.

“Our endeavour in the Reserve Bank has always been to implement timely and carefully calibrated measures to derive maximum impact.” Das said. This will continue to be the guiding principle for all future actions also.

Quoting Mahatma Gandhi, he said: “There is nothing that cannot be attained by patience and equanimity”.