New Data Ecosystems Can Spur New Products – MeitY

MeitY’s Simmi Chaudhary says fintech can transform traditional financial sector

NEW DELHI, Aug 31 (The CONNECT) – Fintech industry has emerged as a key catalyst for financial inclusion with an immense potential to be a game changing, disruptive, innovation capable of transforming the traditional financial sector.

Stating this, Simmi Chaudhary, Economic Adviser & Group Coordinator, MeitY, said, three digital forces will drive transformation – Greater ease with which people can connect, collaborate, transact and share information, opportunity for companies to increase productivity by automating routine task and greater ease with which the organisations can analyse data to make insights and to improve decision making.’

The interplay of these forces will create new data ecosystems which in turn will spur new products, services and channels in virtually every business sector and create economic value for consumers as well as for entrepreneurs, Simmi said on the last Friday while speaking at the Delhi Micro Experience of FinTech Festival India 2021-22.

“We are now moving towards breaking down silos to ensure convergence, reorganizing valuable datasets, building innovative solutions, ensuring aggressive infusion of emerging technologies in developing products that are solving persisting societal problems.” she added.

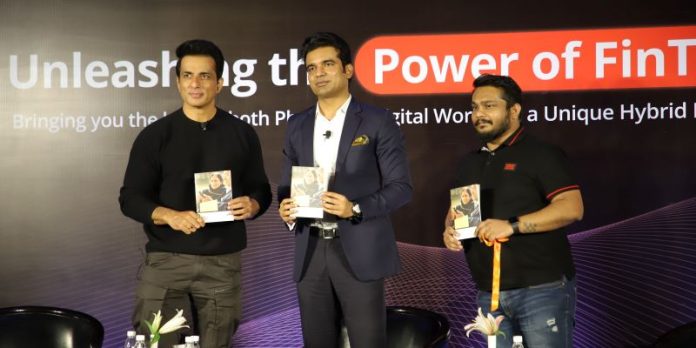

The daylong conference in Delhi was also attended by some well-known stalwarts such as leading actor, philanthropist, investor and entrepreneur – Sonu Sood, Abhishek Singh(IAS), Deputy Commissioner, New Delhi, Dr. Ajai Garg, Scientist F/ Director, Ministry of Electronics and Information Technology (MEITY), Govt. of India., Rajat Mukarji, Director General, Broadband India Forum, Ashish Singhal, Co-Founder & Chief Executive Officer, CoinSwitch, Gaurav Chopra, Founder & Chief Executive Officer, IndiaLends and Gurjodhpal Singh and Chief Executive Officer, Tide India among others.

Dr. Ajai Garg, Scientist F/ Director, Ministry of Electronics and Information Technology (MEITY), Govt. of India., said, “India has shown the way to the world by using technology to change the way general public can be benefitted and included in the growth of an economy. Regulators follow the technology, if the technology shows enough promise the regulators will back it up in the fintech market. UPI is a live example of that. Similar possibilities exist for micro lending fintechs as well. When the Govt. and private sector comes together challenges can be turned into bigger opportunities, Aadhar is an example of this. India should be home for small plug and play cybersecurity. solutions for different sectors.”

Sonu Sood, said, “Fintechs are the leaders of tomorrow. In another couple of years the whole country will be fintech-connected. I am already associated with a rural fintech called SpiceMoney which is driving financial inclusion in the interiors of our country and also open to explore more opportunities in the fintech space.”

A white paper on ‘RegTech, 5G & Crypto in India’ was also unveiled.

Fintech Festival India is the country’s largest FinTech confluence, to be held till March 2022. It will witness participation from over 500 Indian and global leaders and 12,000+ delegates. FFI will see participation from Brazil, Israel, UK, Russia, Canada, Finland, Japan, Singapore among others.