Kotak Institutional Equities presents its Thoughts on ‘Trump’ trade

The complete and unprecedented control of all arms of the US government by the Republican Party may result in (1) higher US earnings through likely corporate tax cuts, (2) higher tariffs on imports into the US and (3) higher US fiscal deficits, says

The former two will be a negative for EMs (Emerging Markets) in general, and the latter will result in eventual US dollar weakness after the initial euphoria.

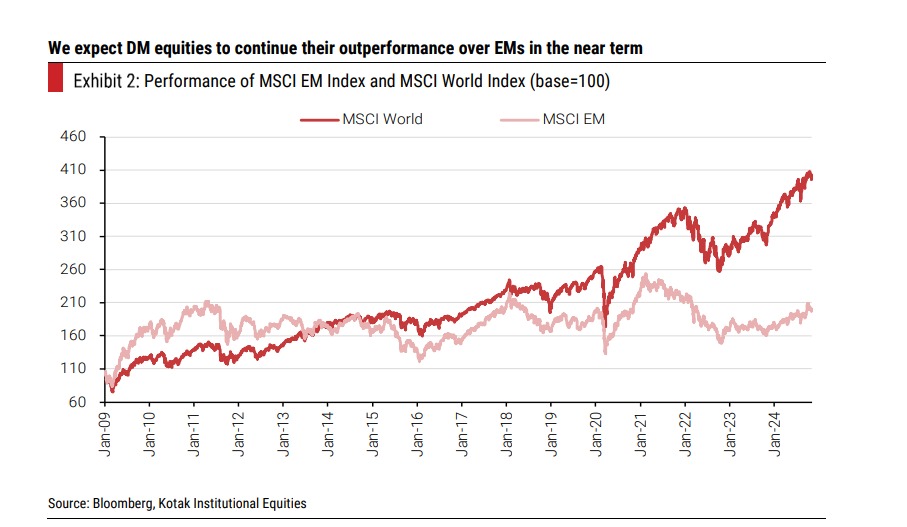

Likely stronger US growth will favour US markets over EMs

The Republican Party’s complete control of the presidentship, the house (likely) and the senate may result in pro-growth economic policies, such as (1) lower tax rates for corporates and individuals and (2) a higher focus on domestic manufacturing. The market has already factored in (1) higher earnings for the US market and (2) a stronger US dollar (see Exhibits 1-3).

EMs are even less likely to find favour with asset allocators, especially in light of likely worsening in global geopolitics and trade. FPI outflows from India may accelerate in the near term, given the dominance of passive inflows in FPI flows (see Exhibits 4-5).

Lastly, any large fiscal stimulus from China to offset the negatives of higher US tariffs on Chinese imports could be a further negative for FPI flows into India.

Tariff-driven rebalancing of US trade deficits

In our view, a more protectionary trade regime in the US will impact (1) global GDP (including the US) growth and trade; other countries are likely to implement retaliatory tariff increases and (2) US inflation negatively. The new US administration is likely to focus on a tariff-driven approach to rebalance the large US trade deficit.

The worst-case situation could see meaningfully higher tariffs on goods imported from China and moderate tariffs on goods imported from other countries.

Indian exports may benefit at the margin from a differentiated tariff regime, but the net benefit will depend on its competitiveness versus on-shoring and exports from other economies.

Higher bond yields and stronger US dollar in the near term

The inflationary nature of the new policies is likely to result in higher US interest rates. We note that US bonds have already moved up by 15 bps over the past week, while market expectations of Fed Fund rates in CY2025 have also been reset by a similar quantum (see Exhibits 6-7).

As a result, the US dollar is likely to stay stronger in the near term. However, it will weaken over the medium term due to likely higher US government deficits (see Exhibit 8).

Several contradictions in the ‘Trump’ trade

We note several contradictions in the ‘Trump’ trade—(1) corporate tax cuts in the US may result in higher earnings and spending on IT services but will also result in higher fiscal deficits (if unfunded) and USD weakness in the medium term, (2) higher import tariffs will result in higher inflation and interest rates and lower growth in the US, (3) ‘America First’ policy may limit outsourcing and impose fresh restrictions on visas and (4) a likely anti-ESG approach may not be positive for a portion of India’s exports (solar PV modules, etc.)