Stock price hits life time high, IIFL Securities sees more upside as company net profit shoots by 40.6%

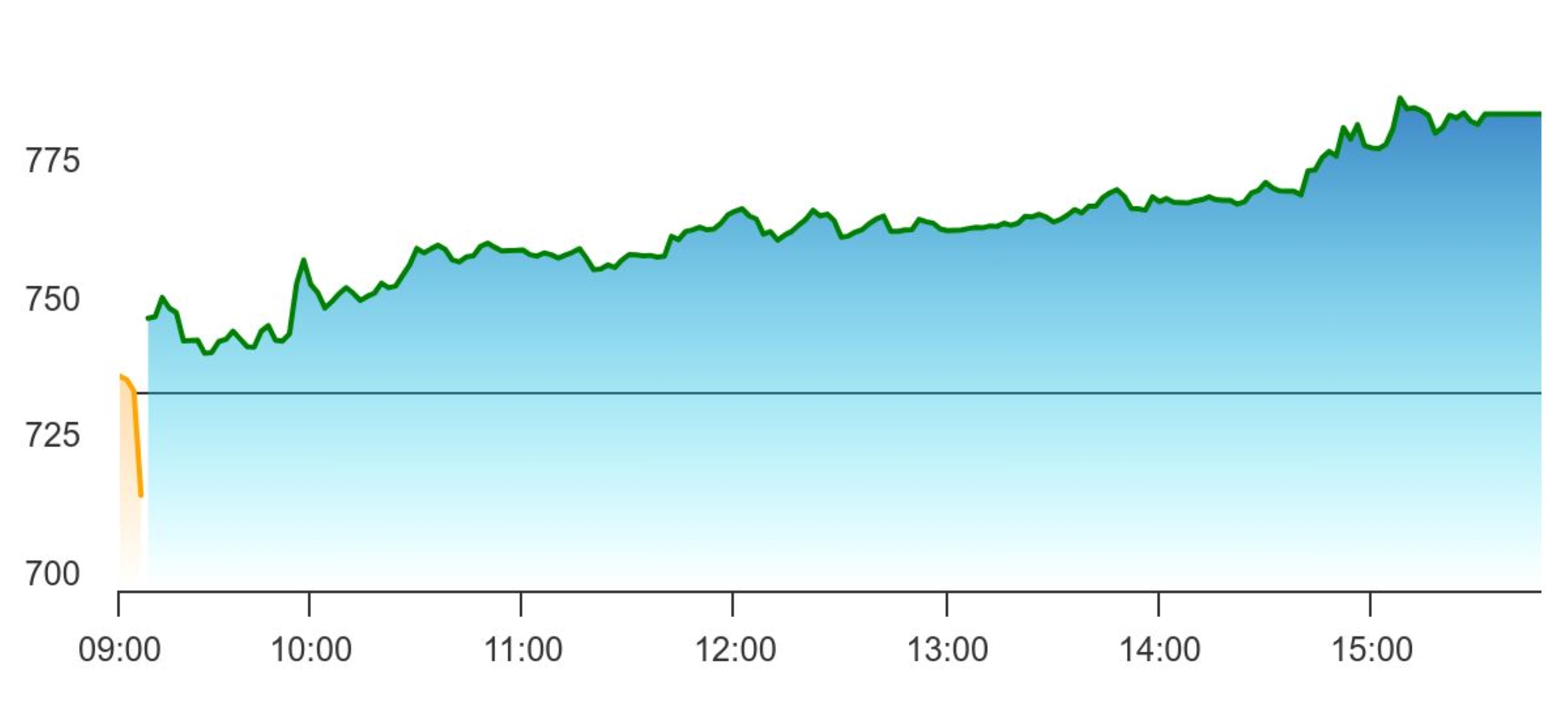

MUMBAI, Aug 7 (The CONNECT) – Shares of ethnic snacks maker Bikaji Foods International Ltd surged to a lifetime high of Rs 794.45, and brokerages say the growth may be unstoppable. The stock opened at Rs 741.10 on the NSE and climbed to Rs 794.45, marking a new lifetime high.

IIFL Securities in a note had issued a buy recommendation for Bikaji Foods International on August 6, setting a target price of Rs 770, indicating an upside of 3 % from the current market price of Rs 747.85. The brokerage firm believes that the company’s strong brand presence, diversified product portfolio, and expansion plans make it an attractive investment opportunity.

The company’s strong brand recognition and wide distribution network have contributed to its growth, but competition in the snacks industry remains intense. Investors should carefully consider the company’s fundamentals and market conditions before making any investment decisions.

Bikaji Foods International Ltd. has received an ‘AA-‘ rating by Stratzy’s MOST Framework. The company’s strong management team and consistent financial performance have contributed to its high rating. Bikaji Foods has a positive outlook for the future, driven by the growing demand for its products in India and abroad. The company’s financials are sound, with low debt levels and a strong cash position. Bikaji Foods is also committed to safety and quality, with a focus on maintaining high standards of food production.

In the June quarter, Bikaji Foods reported impressive financial results. The company’s consolidated net profit jumped by 40.6% to Rs 58.06 crore compared to the same period last year. This growth was driven by a 15.24% increase in revenue, which reached Rs 555.12 crore. Additionally, Bikaji Foods saw a 16.2% year-on-year volume growth across all categories, while total income rose by 18.8% to Rs 579.41 crore. These figures highlight the company’s robust performance and market demand for its products.

Bikaji Foods International is the third-largest ethnic snacks company in India with a notable international presence. The company specializes in selling Indian snacks and sweets and has been recognized as the second-fastest-growing company in the Indian organized snacks market, according to a report by Frost & Sullivan. The Bikaji brand was launched in 1993 by Shiv Ratan Agarwal, who had a deep understanding of Indian tastes and preferences. As of March 31, 2024, the company operates in 25 states and four union territories in India. Additionally, Bikaji Foods exports its products to 25 countries, including North America, Europe, the Middle East, Africa, and the Asia Pacific region.

Bikaji Foods offers a diverse product range categorized into six main segments: bhujia, namkeen, packaged sweets, papad, western snacks, and other items such as gift packs, frozen food, mathri, and cookies. This wide variety has helped the company cater to a broad customer base both domestically and internationally.

From the start of the calendar year, shares of Bikaji Foods have surged by over 43%, significantly outpacing the 12% rise in the benchmark Nifty 50 index during the same period.

The Company in Q1FY25 Conference call said “The management is aiming for 13-15 per cent volume growth for FY25, and expects product prices to increase by about 2-3 per cent. Return of rural demand is likely to aid overall demand recovery, with concentration of Western snacks being high. Bikaji has already achieved expansion to 21k outlets, of its FY25 distribution expansion target of 50k outlets”.