Samhi’s Offering Is Fresh Issue + OFS

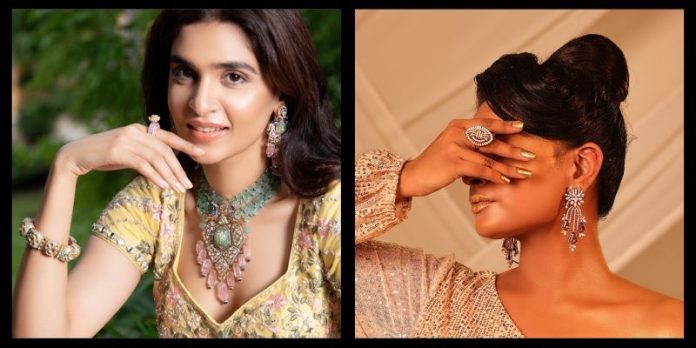

Motisons Jewellers had filed its IPO papers for a fresh issue of 33.47 million equity shares with a face value of Rs 10 apiece.

MUMBAI, Sep6 (The CONNECY) – Gurugram-based SAMHI Hotels and Jaipur-based Motisons Jewellers have received final observations from capital markets regulator Securities and Exchange Board of India (SEBI) for their IPOs

Samhi Hotels had filed preliminary IPO papers on March 31, 2023. Its issue has a face value of Re 1 per equity share comprises a fresh issue of Rs 1,000 crore and an offer for sale (OFS) of 9 million equity shares by selling shareholders.

The offer for sale (OFS) comprises up to 4.23 million equity shares by Blue Chandra Pte. Ltd., up to 2.48 million equity shares by Goldman Sachs Investments Holdings (Asia) Limited, up to 1.55 million equity shares by GTI Capital Alpha Pvt Ltd, and up to 7.39 lakh equity shares by International Finance Corporation. It is a partial exit by the existing shareholders to meet the listing regulations.

JM Financial Limited and Kotak Mahindra Capital Company Limited are the book-running lead managers for the issue, and KFin Technologies Limited is the registrar.

Motisons Jewellers had filed its preliminary IPO papers with Sebi in March 2023. The issue with a face value of Rs 10 per equity share is entirely a fresh issue of 33.47 million equity shares, with no offer for sale component.

Holani Consultants Private Limited is the sole book running lead manager to the issue and Link Intime India Private Limited is the registrar.