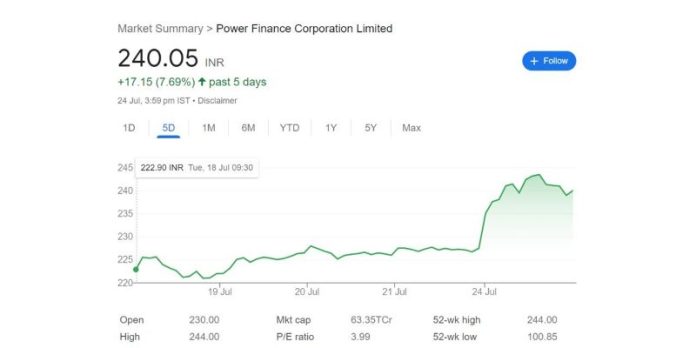

Share Quotes Rs 244 On The Bourses

PFC is looking to fund projects like offshore wind, pumped hydro storage, solar modules and cells, among others in the clean energy space.

MUMBAI, July 24 (The CONNECT) – Power Finance Corporation’s scrip today achieved its 52-week high at Rs. 244 per share in the stick markets amid reports that the company has signed as many as 20 MoUs for more than ₹ 2.37 Lakh Crore covering Solar, Wind Power, Green Hydrogen, Battery Storage and Electric Vehicle sectors.

The stock’s P/E ratio works out to 3.98. The total traded quantity today was of 12, 03, 574 shares.

As part of its plan to position itself as the focal funding agency for energy transition, the Power Finance Corporation Ltd (PFC), executed various Memoranda of Understanding with public and private sector companies.

Adani, Greenco, ReNew, Continuum, Avaada, JBM Auto, Megha Engineering & Infrastructure Limited, Rajasthan Renewable Energy were some of the companies with whom PFC signed the MoU. PFC is a leading financier of Energy Transition in India and these MoU highlight PFC’s commitment to consistently increase its energy transition portfolio and steer Nation’s drive of Energy Transition Goals. The MoU assume significance in the backdrop of ongoing deliberations on energy transition under India’s G20 presidency.

PFC enjoys the unique advantage of providing funds for longer tenure at competitive rates and taking larger exposures. PFC is looking to fund projects like offshore wind, pumped hydro storage, solar modules and cells, among others in the clean energy space.

The company recently diversified its loan portfolio by foraying into infrastructure projects such as refineries, ports, roads, metro, biofuels, waste to energy etc.